Sustainable Financial Innovation: A Comprehensive Delineation of Emerging Trends, Challenges, and Opportunities

In the face of mounting environmental and social challenges, sustainable financial innovation has emerged as a pivotal force in shaping a more sustainable and equitable future. This article presents a comprehensive analysis of the rapidly evolving field of sustainable financial innovation, providing a thorough understanding of its emerging trends, challenges, and opportunities.

4.5 out of 5

| Language | : | English |

| File size | : | 12922 KB |

| Screen Reader | : | Supported |

| Print length | : | 314 pages |

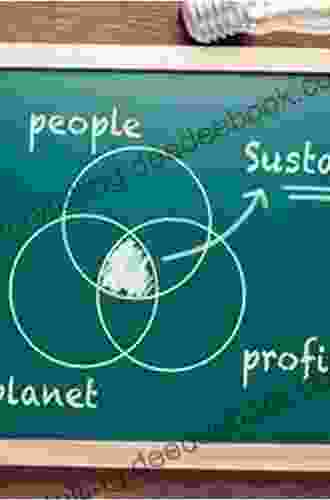

The concept of sustainable financial innovation encompasses financial products, services, and business models that explicitly consider environmental and social impact alongside financial returns. This transformative approach to finance seeks to align the interests of investors, corporations, and society at large, driving positive change across various sectors.

Emerging Trends in Sustainable Financial Innovation

Green Finance

Green finance refers to financial products and services specifically designed to support projects and initiatives that promote environmental sustainability. Examples include green bonds, which finance projects such as renewable energy, energy efficiency, and climate-resilient infrastructure.

The rapid growth of green finance is driven by increasing investor demand for sustainable investments, as well as supportive government policies and regulations. Green bonds have become particularly popular due to their ability to mobilize capital for large-scale sustainable infrastructure projects.

Impact Investing

Impact investing involves investing in enterprises and organizations with the explicit intention of generating both financial returns and positive social or environmental impact. This approach goes beyond traditional financial considerations to incorporate measurable social and environmental metrics into the investment process.

Impact investing is gaining traction as investors seek to align their investments with their values and contribute to social change. The field has seen the emergence of dedicated impact investment funds, as well as the incorporation of impact considerations into mainstream investment portfolios.

Sustainable Development Goals (SDGs)

The United Nations Sustainable Development Goals (SDGs) provide a globally recognized framework for addressing critical social, economic, and environmental challenges. Sustainable financial innovation plays a crucial role in aligning financial flows with the SDGs, directing capital towards projects and initiatives that contribute to achieving these goals.

Financial institutions and investors are increasingly developing financial products and services that explicitly target specific SDGs, such as green bonds for renewable energy (SDG 7) or social impact bonds for affordable housing (SDG 11).

Environment, Social, and Governance (ESG) Investing

ESG investing involves considering environmental, social, and governance (ESG) factors in investment decisions. ESG factors provide a holistic view of a company's sustainability performance, encompassing aspects such as carbon emissions, labor practices, and board diversity.

ESG investing has gained widespread adoption as investors recognize the importance of incorporating non-financial factors into their decision-making process. ESG-focused funds and indices have proliferated, enabling investors to align their portfolios with their sustainability preferences.

Challenges in Sustainable Financial Innovation

Data and Measurement

One of the key challenges in sustainable financial innovation is the availability and reliability of data on environmental and social impact. Measuring the impact of financial products and services on sustainability is complex and requires robust methodologies and standardized reporting frameworks.

The lack of comprehensive and accessible data can hinder the development and evaluation of sustainable financial innovations, as well as the ability of investors to make informed decisions.

Regulatory Barriers

In some jurisdictions, regulatory frameworks may not be fully supportive of sustainable financial innovation. For example, regulations governing green bonds or impact investing may be unclear or restrictive, limiting the ability of these instruments to scale.

Policymakers need to address regulatory barriers and create an enabling environment for sustainable financial innovation to flourish.

Lack of Standardization

The field of sustainable financial innovation is characterized by a lack of standardization across different products and services. This inconsistency can make it difficult for investors to compare and evaluate different options, as well as for policymakers to develop effective regulatory frameworks.

Standardization efforts, such as the development of common definitions and reporting methodologies, are essential to enhance transparency and facilitate the growth of sustainable financial innovation.

Opportunities for Sustainable Financial Innovation

Accelerating the Transition to a Low-Carbon Economy

Sustainable financial innovation can play a catalytic role in accelerating the transition to a low-carbon economy by directing capital towards renewable energy, energy efficiency, and other climate-friendly technologies.

Financial instruments such as green bonds and sustainability-linked loans can incentivize corporations to reduce their carbon footprint and invest in sustainable practices.

Promoting Social and Economic Inclusion

Sustainable financial innovation can contribute to social and economic inclusion by providing financial access and support to underserved communities. This includes microfinance programs for low-income individuals, social impact bonds for affordable housing, and financial education initiatives for marginalized populations.

By expanding access to financial services and empowering communities, sustainable financial innovation can foster more equitable and inclusive economic growth.

Enhancing Risk Management

In addition to its environmental and social benefits, sustainable financial innovation can enhance risk management by incorporating ESG factors into investment decisions. ESG factors can provide insights into a company's long-term sustainability and resilience, helping investors identify and mitigate potential risks.

By considering ESG factors, financial institutions and investors can improve their risk-adjusted returns and contribute to a more stable and sustainable financial system.

Sustainable financial innovation is a transformative force with the potential to shape a more sustainable and equitable future. Emerging trends such as green finance, impact investing, and ESG investing are driving the development of innovative financial products and services that align financial returns with positive environmental and social outcomes.

However, challenges such as data and measurement issues, regulatory barriers, and a lack of standardization need to be addressed to fully unlock the potential of sustainable financial innovation.

By fostering collaboration between financial institutions, policymakers, and sustainability advocates, we can create an enabling environment for sustainable financial innovation to thrive. This will enable us to mobilize capital towards sustainable solutions, accelerate the transition to a low-carbon economy, promote social and economic inclusion, and enhance risk management in the financial sector.

As we navigate the complex challenges of the 21st century, sustainable financial innovation offers a beacon of hope, empowering us to forge a path towards a more sustainable and prosperous future for all.

4.5 out of 5

| Language | : | English |

| File size | : | 12922 KB |

| Screen Reader | : | Supported |

| Print length | : | 314 pages |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Book

Book Novel

Novel Page

Page Text

Text Reader

Reader Library

Library Newspaper

Newspaper Shelf

Shelf Glossary

Glossary Foreword

Foreword Preface

Preface Synopsis

Synopsis Annotation

Annotation Footnote

Footnote Manuscript

Manuscript Scroll

Scroll Tome

Tome Bestseller

Bestseller Classics

Classics Library card

Library card Narrative

Narrative Memoir

Memoir Reference

Reference Encyclopedia

Encyclopedia Dictionary

Dictionary Thesaurus

Thesaurus Card Catalog

Card Catalog Borrowing

Borrowing Stacks

Stacks Lending

Lending Academic

Academic Reading Room

Reading Room Rare Books

Rare Books Interlibrary

Interlibrary Literacy

Literacy Thesis

Thesis Awards

Awards Book Club

Book Club Theory

Theory Textbooks

Textbooks Robin Totton

Robin Totton Yamily Moreno

Yamily Moreno Pamela Binnings Ewen

Pamela Binnings Ewen Luke Flowers

Luke Flowers Scott Strand

Scott Strand Alan Furst

Alan Furst Larry E Heck

Larry E Heck Natalie Diaz

Natalie Diaz Robert Kelchen

Robert Kelchen Christoph Martin Wieland

Christoph Martin Wieland Josh Zimmerman

Josh Zimmerman Dylan Steel

Dylan Steel Lynn Murphy

Lynn Murphy Jennifer Hilary

Jennifer Hilary Emily Hayday

Emily Hayday Mark Scott

Mark Scott Dwight B Hinkel

Dwight B Hinkel Margery Kerstine

Margery Kerstine Andrea Harris

Andrea Harris Sandeep Senghera

Sandeep Senghera

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

Pablo NerudaThe Princess Guide to Rome: Fashion, Glamour, and Lifestyle for the Modern...

Pablo NerudaThe Princess Guide to Rome: Fashion, Glamour, and Lifestyle for the Modern... Todd TurnerFollow ·7.2k

Todd TurnerFollow ·7.2k Galen PowellFollow ·13.3k

Galen PowellFollow ·13.3k Gordon CoxFollow ·13.6k

Gordon CoxFollow ·13.6k Colin RichardsonFollow ·5.8k

Colin RichardsonFollow ·5.8k Aldous HuxleyFollow ·4.1k

Aldous HuxleyFollow ·4.1k Isaac AsimovFollow ·9.6k

Isaac AsimovFollow ·9.6k Jamie BellFollow ·2.6k

Jamie BellFollow ·2.6k Kurt VonnegutFollow ·19.9k

Kurt VonnegutFollow ·19.9k

Howard Blair

Howard BlairClassical Music Themes for Easy Mandolin, Volume One

Classical Music Themes for Easy Mandolin,...

Paulo Coelho

Paulo CoelhoThe Heretic Tomb: Unraveling the Mysteries of a Lost...

Synopsis In Simon Rose's captivating debut...

Rodney Parker

Rodney ParkerThe Passionate Friends Annotated Wells: A Deeper...

Unveiling the...

Ed Cooper

Ed CooperDelicious Stories of Love, Laughs, Lies, and Limoncello...

In the heart of...

Elmer Powell

Elmer PowellHal Leonard Piano For Kids Songbook: Unleashing the...

Music holds immense...

4.5 out of 5

| Language | : | English |

| File size | : | 12922 KB |

| Screen Reader | : | Supported |

| Print length | : | 314 pages |