Why Activist Investors and Other Contrarians Battle for Control of Losing Companies

4.6 out of 5

| Language | : | English |

| File size | : | 3084 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 236 pages |

| Lending | : | Enabled |

Activist investors and other contrarians often target losing companies, believing that they can turn them around and make a profit. This can be a risky strategy, but it can also be very rewarding.

What is an activist investor?

An activist investor is a type of investor who takes an active role in influencing the management of a company. They typically do this by acquiring a significant stake in the company and then using their voting power to push for changes.

Activist investors often target companies that they believe are undervalued or have not been managed well. They may push for changes such as selling off underperforming assets, cutting costs, or replacing management.

What is a contrarian investor?

A contrarian investor is a type of investor who goes against the grain. They typically buy stocks that are out of favor with the market, believing that they are undervalued.

Contrarian investors often target losing companies because they believe that they have the potential to turn around. They may be willing to take on more risk than other investors, believing that the potential reward is worth it.

Why do activist investors and contrarians target losing companies?

There are several reasons why activist investors and contrarians target losing companies.

- They believe that they can turn them around. Activist investors and contrarians believe that they have the expertise and experience to identify undervalued companies and turn them around. They may have a history of successful turnarounds, or they may have a plan for how they will improve the company's performance.

- They see an opportunity to make a profit. Activist investors and contrarians believe that they can make a profit by buying losing companies at a low price and then selling them at a higher price after they have turned them around.

- They want to make a difference. Some activist investors and contrarians are motivated by a desire to make a difference in the world. They may believe that they can use their influence to improve the company's performance and create value for all stakeholders.

What do activist investors and contrarians do to try and turn around losing companies?

Activist investors and contrarians use a variety of tactics to try and turn around losing companies.

- They may acquire a significant stake in the company. This gives them the voting power to push for changes.

- They may push for changes in management. They may believe that the current management team is not ng a good job and that a new team is needed to turn the company around.

- They may push for changes in the company's strategy. They may believe that the company's current strategy is not working and that a new strategy is needed.

- They may sell off underperforming assets. They may believe that the company is holding on to assets that are not profitable and that these assets should be sold off.

- They may cut costs. They may believe that the company is spending too much money and that costs need to be cut.

Can activist investors and contrarians be successful?

Activist investors and contrarians can be successful in turning around losing companies, but it is not always easy. There are many challenges that they may face, such as resistance from management, a lack of support from shareholders, and a difficult economic environment.

However, if an activist investor or contrarian is successful in turning around a losing company, the rewards can be great. They can make a lot of money, they can make a difference in the world, and they can earn the respect of their peers.

Activist investors and contrarians play an important role in the market. They can help to identify undervalued companies and turn them around, creating value for all stakeholders. However, it is important to remember that investing in losing companies is a risky strategy. It is important to do your research and understand the risks involved before investing.

4.6 out of 5

| Language | : | English |

| File size | : | 3084 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 236 pages |

| Lending | : | Enabled |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Story

Story Genre

Genre Reader

Reader Library

Library E-book

E-book Magazine

Magazine Newspaper

Newspaper Paragraph

Paragraph Bookmark

Bookmark Glossary

Glossary Bibliography

Bibliography Foreword

Foreword Footnote

Footnote Manuscript

Manuscript Scroll

Scroll Codex

Codex Bestseller

Bestseller Classics

Classics Narrative

Narrative Autobiography

Autobiography Dictionary

Dictionary Thesaurus

Thesaurus Narrator

Narrator Character

Character Librarian

Librarian Catalog

Catalog Card Catalog

Card Catalog Borrowing

Borrowing Archives

Archives Periodicals

Periodicals Study

Study Lending

Lending Academic

Academic Journals

Journals Rare Books

Rare Books Literacy

Literacy Storytelling

Storytelling Awards

Awards Reading List

Reading List Theory

Theory Catherine Bybee

Catherine Bybee Samantha Shannon

Samantha Shannon Maddison Cole

Maddison Cole Wendy Craig

Wendy Craig 2008th Edition Kindle Edition

2008th Edition Kindle Edition Charles Lowenhaupt

Charles Lowenhaupt Mark Godsey

Mark Godsey Matthew Dermody

Matthew Dermody Geoff Watts

Geoff Watts Robert Coorey

Robert Coorey John R Shannon

John R Shannon Joanna Neil

Joanna Neil Jan Ollis

Jan Ollis David R Bernstein

David R Bernstein Shenaia Lucas

Shenaia Lucas Matthew Soerens

Matthew Soerens David A Sherris

David A Sherris Stan Kirby

Stan Kirby Mike Read

Mike Read Konstantin Degner

Konstantin Degner

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

Griffin MitchellThe Soils of Iceland: A Comprehensive Guide to Iceland's Unique Soil Types

Griffin MitchellThe Soils of Iceland: A Comprehensive Guide to Iceland's Unique Soil Types Jeff FosterFollow ·15.3k

Jeff FosterFollow ·15.3k Avery SimmonsFollow ·8.7k

Avery SimmonsFollow ·8.7k Felix HayesFollow ·6.7k

Felix HayesFollow ·6.7k Anton FosterFollow ·15.9k

Anton FosterFollow ·15.9k Joshua ReedFollow ·19.9k

Joshua ReedFollow ·19.9k Art MitchellFollow ·9.9k

Art MitchellFollow ·9.9k Darrell PowellFollow ·9.7k

Darrell PowellFollow ·9.7k Hudson HayesFollow ·15.5k

Hudson HayesFollow ·15.5k

Howard Blair

Howard BlairClassical Music Themes for Easy Mandolin, Volume One

Classical Music Themes for Easy Mandolin,...

Paulo Coelho

Paulo CoelhoThe Heretic Tomb: Unraveling the Mysteries of a Lost...

Synopsis In Simon Rose's captivating debut...

Rodney Parker

Rodney ParkerThe Passionate Friends Annotated Wells: A Deeper...

Unveiling the...

Ed Cooper

Ed CooperDelicious Stories of Love, Laughs, Lies, and Limoncello...

In the heart of...

Elmer Powell

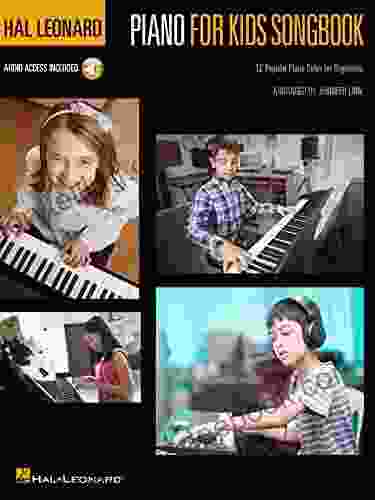

Elmer PowellHal Leonard Piano For Kids Songbook: Unleashing the...

Music holds immense...

4.6 out of 5

| Language | : | English |

| File size | : | 3084 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 236 pages |

| Lending | : | Enabled |